Hi,

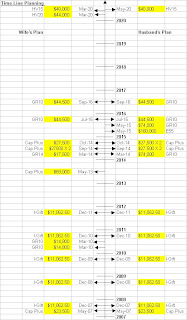

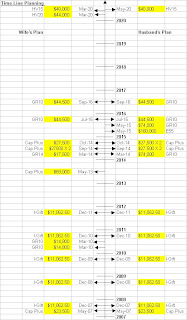

I have a client, with his permission, I will share with you how he has planned towards retirement. If you click on the image on the left, you will see a better picture.

Whenever he has spare cash, or CPF or SRS, he will set aside to plans to mature in the future. Following is the time line for mostly the traditional, Growth Policy, I-Gift, Capital Plus, Harvest Policy and even Endowment Plan. They have many investment linked policies as well.

The maturity is well placed for the future.

Some time we procastinate and time and time again, no action is taken and funds are left in the bank for low interest, and in the CPF and SRS not used. Such placement over the years will also provide additional insurance coverage which will be useful for insurance protection as well.

Should you wish to plan along the way, it may be good to consider. This couple also has investment linked Plan ( Combined Funds - Growth & Balanced Funds ) which I have not asked for permission to show. This will be in addition to the time line, which can be quite useful in between when there is no maturity.

Unknowingly, they have set aside spares for the future retirement needs and for the children's education as well.

The discipline starts quite far back. If one puts $10,000 the maturity in 10 years is about $14,800. When it matures, one can roll over for re-investment.

Example their Capital Plus would mature on May 2007, they will re-invest $20,000 each and keep the balance for maturity at the next stage is 2017. This will give them a projected return of $29,600 then. Start planning early to have a better retirement and to meet contingency needs in between.

Have you drawn a time line for yourself to target towards retirement?

Promotion is on next month forward from 1st February, with $200 Ntuc Fairprice vouchers for cash placed and 1% additional bonus for CPF Funds for $20,000. Additional $100 voucher per block of $10,000 will be given. Meaning if one place $50,000 cash, voucher of $500 will be given, offer is for limited period only.