As we approach the end of 2010, may I take this opportunity to wish you and family joy, health and wealth.

2010 has been an exciting year and a good year for most as economy picks up.

I will always do what I can when I am needed. This year has not seen any major claim, which is good, meaning most are in good health. Do pardon me for any lapse of service, if any.

It has also been exciting even into last few days when one of my client's IncomeShield has been switched out by fraud. The case has been reported to police for investigation since signature is not my client's signature. Important is to get it reinstated, thus proof of fraud is important in this case. This show case that there are some black sheep in the industry. I have never imagined how this can happen.

2011 seems bullish and may be a year to watch out, to liquidate some investment funds if it gets too bullish or maybe 2012. This is just my personal take on the economy. With all respect, during market down turn, no fund manager speaks, but after market recovered, most will talk about upturn and how record will be achieved forward, but when it collapsed, most go silent again for a long time. So when there is talk of bullish market and how index record will climb, perhaps is a sign to consider if it is time to liquidate. What goes up will come down, easy to say but always never take action until too late.

Hope 2011 will be another exciting and prosperous year, wishing you and family all the best.

Friday, December 31, 2010

Tuesday, September 7, 2010

Your car may not be due for inspection !

Many car owners received road tax renewal and on impulse sent car for inspection which is unnecessary. If car inspection is required, it will be specified at the bottom of the road tax. Inspection interval for car is 2 years after year 3. Problem is inspection centres are sending out their leaflet based on database. So please check and do not pay for nothing.

Inspection is required only when official letter is sent from LTA. And it is reflected clearly on the road tax renewal disc sent to car owner.

I think many have sent their car for inspection without realising it is inspection centre's marketing letter and not request from LTA.

Inspection centres are laughing all the way to the bank.

LTA's requirement for inspection for car is biennially, every 2 years, there is a list of vehicle inspection requirements for all types of vehicles, link at http://www.onemotoring.com.sg/publish/onemotoring/en/lta_information_guidelines/maintain_vehicle/inspection.html

Wednesday, July 21, 2010

Plan to meet NEEDS.

Concluded the biggest sums assured I ever done yesterday, $2 million term and $1 million critical illness Living Rider. Beyond my imagination, pass through the stringent medical check and still could get standard rate. A case that I never think will get standard when one is a Hepatitis B carrier, but with anti-bodies.

On the same day, a client died, submitting a claim for $10,000 plus bonus.

Some time it is an awful sense of responsibility and some time guilt that I am not able to convince those who refuse to see the need, how one should plan, how I can help others see their needs.

On the same day, a client died, submitting a claim for $10,000 plus bonus.

Some time it is an awful sense of responsibility and some time guilt that I am not able to convince those who refuse to see the need, how one should plan, how I can help others see their needs.

Tuesday, June 29, 2010

Action to do when car tyre has a blow-out,puncture.

A friend sent me this video clip on what action to take during tyre blow out, I think it is good public education and I like to share it with you. Just click to view the video.

I think the natural instinct when a tyre puncture is to hit the brakes, but it is not so, view the video for advice.

I think the natural instinct when a tyre puncture is to hit the brakes, but it is not so, view the video for advice.

Thursday, June 10, 2010

Colon Cancer Claim - 3 C's ?

Another of my client, age 45, WAS DIAGNOSED WITH MODERATELY DIFFERENTIATED ADENOCARCINOMA OF RECTUM, commonly known as colon cancer.

Life is fragile. IncomeShield and a critical illness plan is so important ( not to advertise ), I have seen and met and plan for many and such are the basics in insurance planning.

I have always mention that whatever Shield plan, one need to be insured. Basic Medishield or any of the private medical insurance plans, Shield Plan.

Critical Illness or Dread Diseases will cripple a person if one is not prepared for the bills that will come along with it.

It is NEEDS to be met before WANTS.

Put the essential needs in place before planning for savings or investment plans.

There is nothing new to write about but just the reality of life.

Life is fragile. IncomeShield and a critical illness plan is so important ( not to advertise ), I have seen and met and plan for many and such are the basics in insurance planning.

I have always mention that whatever Shield plan, one need to be insured. Basic Medishield or any of the private medical insurance plans, Shield Plan.

Critical Illness or Dread Diseases will cripple a person if one is not prepared for the bills that will come along with it.

It is NEEDS to be met before WANTS.

Put the essential needs in place before planning for savings or investment plans.

There is nothing new to write about but just the reality of life.

Friday, June 4, 2010

How to reduce income tax?

Most of us would think that to reduce income tax, is to contribute to SRS, Supplementary Retirement Scheme.

There is also another avenue, that is to do cash top up to parent's retirement account.

If your parent is retired and above 62, and you have been giving your parents allowance, one can actually do cash top up of up to $7000 to parent's CPF Retirement account and the parent gets a monthly draw down of $297.

If you have been giving allowance to your parents, this is one way to claim tax by doing cash top up.

You can have a joint bank account, and the monthly payout from the MSS, $297 will be credited to the account monthly and at the same time there is tax relief.

Wednesday, March 31, 2010

Timeline planning

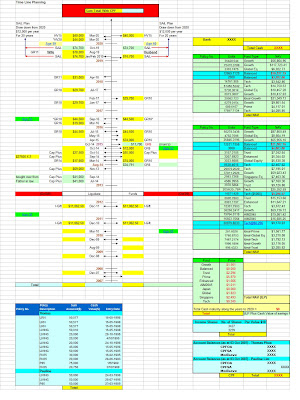

Timeline Planning - ExpandedA spreadsheet to plot out the timeline and to gather one's assets in one page view is quite helpful.

Timeline Planning - ExpandedA spreadsheet to plot out the timeline and to gather one's assets in one page view is quite helpful.

You can include your CPF savings, other investments and maturity of policies, bank accounts, etc, to have an indication of what are your assets in total, present and future with a good estimate.

Timeline spreadsheet can also faciliate the planning for future needs and plug any gaps ahead.

Actually, there is no secret in doing this, just use your creativity, and insert formulas to aggregate the portfolios and add on as the time progress and the assets increase over the time.

Have fun in gathering and designing the spreadsheet to your own taste and colours.

(Click on the image and expand the view, you will see the example of the spreadsheet)

Thursday, March 25, 2010

Uni fees in 2015,2020 & 2030 with 6% inflation

In 2006, the fee for other courses in SMU was $7500 per year, and today ( 2010 ), it is $9890 which is 7.16% inflation.

I have drawn out an estimate, based on 6% inflation from 2006, by 2015, 2020 and 2030, the fees could be $12,671, $16,956 and $30,367 respectively.

This is time value of money and the fees will surely goes up with inflation.

Are we prepared in one way or another for our own children?

I know this figures because I paid $7500 per year for my own daughter who is finishing this year, but I have two more to provide for, if they survive the education system.

Unknowingly, I have put aside in the Growth Plan and some investment plans which will come in handy.

I have written an article on time line planning http://phuakahkengthomas.blogspot.com/2007/04/time-line-planning-leap-frog-forward.html in my blog. This was 3 years back, but it gives you an idea of how you can save for the future.

You can click on the link and take a look.

I hope it will be useful for your planning, the actual spreadsheet, if you do it, will have more information and assets you can gather.

Wednesday, January 13, 2010

Thank you for visiting my blog.

On several occasions, I received emails seeking advice and help.

I will try to help, especially those that really need help and is in critical illness, but I have people who email me to check on their relatives pertaining to claims.

I hope that more details and truth can be presented to me if help is needed.

I have one who emailed me about her brother's policies having problem being surrendered without his knowledge, and on checking it is actually under police investigation for forgery.

I have some who asked me to check on possible claim on lapsed policy, but policy did not exist with NTUC INCOME.

I am always willing to help those who need help, but I hope those who contact me, be fair to me. If you have your own servicing agent, please contact them first. All agents are responsible and will assist their clients.

The only situation is you take from direct distrubution channel (business centers, bancassurance, etc ) and these channel do not provide claims assistance. You need to call hotline.

On several occasions, I received emails seeking advice and help.

I will try to help, especially those that really need help and is in critical illness, but I have people who email me to check on their relatives pertaining to claims.

I hope that more details and truth can be presented to me if help is needed.

I have one who emailed me about her brother's policies having problem being surrendered without his knowledge, and on checking it is actually under police investigation for forgery.

I have some who asked me to check on possible claim on lapsed policy, but policy did not exist with NTUC INCOME.

I am always willing to help those who need help, but I hope those who contact me, be fair to me. If you have your own servicing agent, please contact them first. All agents are responsible and will assist their clients.

The only situation is you take from direct distrubution channel (business centers, bancassurance, etc ) and these channel do not provide claims assistance. You need to call hotline.

Subscribe to:

Posts (Atom)